Premiums

TRUSTED VENDOR

- Joined

- Dec 5, 2020

- Messages

- 3,213

Scamalytics is a UK-based cybersecurity company that specializes in fraud risk detection through IP analysis and behavioral data scoring.

The platform uses artificial intelligence and machine learning to identify patterns of suspicious activity across billions of online interactions every month.

Originally created to combat romance scams and fake accounts in the online dating industry, Scamalytics has since expanded into other high-risk sectors such as:

- E-commerce (preventing fake transactions and chargebacks)

- Financial technology (fintech) (identifying account abuse or stolen identities)

- Gaming and advertising (blocking bots and fake clicks)

- Marketplaces and classified platforms (detecting fraudulent listings or spam users)

In short, Scamalytics acts as a global intelligence network for fraud prevention — identifying malicious behavior before it causes financial or reputational damage.

Scamalytics functions through a combination of IP intelligence, behavior analytics, and shared threat data. Here’s how the process works step by step:

1. Data Collection and Fingerprinting

Every time a user visits or registers on a site integrated with Scamalytics, the system automatically analyzes various digital “signals,” including:

- IP address and geolocation

- Device fingerprints

- Connection type (proxy, VPN, or TOR)

- Account activity patterns

- Registration or login behavior

- Past fraud records linked to the IP or device

These data points are anonymized but used collectively to identify risk trends.

2. Risk Scoring

The Scamalytics system then generates a fraud score — a numerical representation of how risky the connection appears to be.

For example:

- A normal user with consistent location and device history might get a low score (5–15%)

- A user connecting via a known proxy or flagged IP could get a medium score (50%)

- A known scam-related IP or suspicious behavioral pattern may trigger a high-risk score (80–100%)

Businesses can automatically block, flag, or manually review high-risk users depending on their policy.

3. Shared Intelligence Network

One of Scamalytics’ greatest strengths is its network effect.

When one company detects a bad actor, that data (IP reputation, fraud pattern, proxy type, etc.) is shared — anonymously — with other network members.

This means that if a scammer tries to create fake accounts on multiple sites, they are already known and pre-flagged by the system before they can cause harm.

This collaborative defense model turns individual fraud detection into a community-driven shield.

4. Machine Learning and Continuous Updates

Scamalytics uses adaptive algorithms that learn from emerging scam behaviors — like new proxy servers, VPN patterns, or automated bot traffic.

The system evolves automatically, ensuring that it doesn’t rely solely on old data or static rules.

This constant evolution helps platforms stay protected even as cybercriminals change tactics.

Scamalytics isn’t just theoretical — it’s actively used across industries. Here are the most common applications:

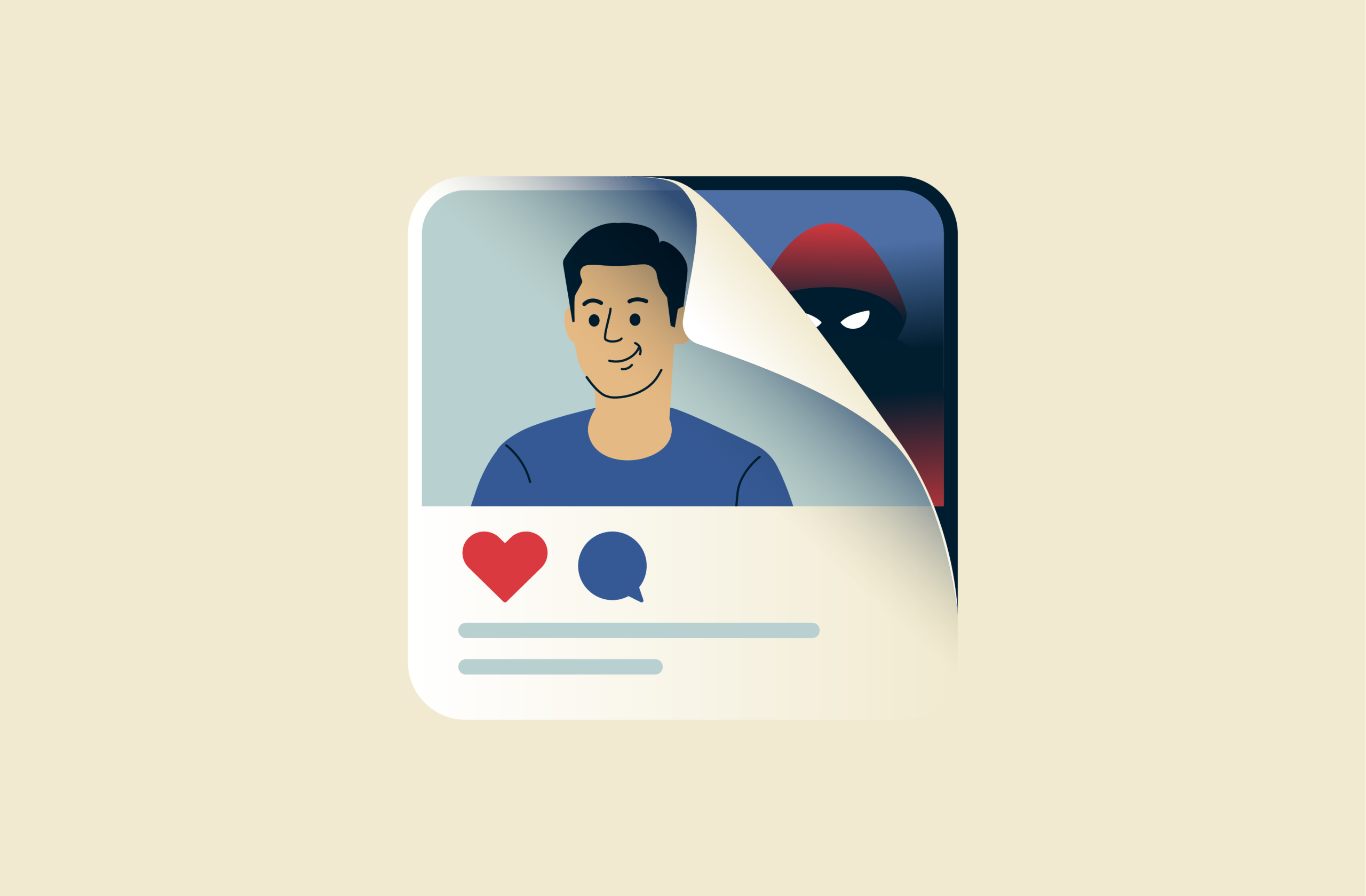

1. Online Dating Platforms

The dating industry was one of the first to suffer from fake profiles, romance scams, and catfishing.

Scamalytics helps platforms:

- Detect fake or stolen photos

- Identify users hiding behind VPNs or multiple fake accounts

- Prevent scam chat behavior and money extortion attempts

As a result, dating sites using Scamalytics report significant drops in fake account creation and increased trust from genuine users.

2. E-commerce and Retail

E-commerce sites often face fraud through stolen credit cards, fake buyers, and chargebacks.

Scamalytics detects unusual IPs and patterns that suggest:

- Automated bots

- Multiple failed transactions

- Orders placed from known fraud networks

This helps merchants block suspicious transactions before the payment is processed.

3. Fintech and Payments

In the world of digital finance, fake or stolen identities are a major threat.

Scamalytics integrates with KYC (Know Your Customer) and AML (Anti-Money Laundering) systems to help verify the legitimacy of users and devices at signup or login.

Banks and payment providers can automatically flag or block high-risk activities, helping them stay compliant with international fraud regulations.

4. Gaming and Ad Networks

Gaming companies use Scamalytics to detect bot players, fake account farming, and ad click fraud — protecting both revenue and player integrity.

Ad networks also rely on Scamalytics to validate that ad impressions and clicks come from real users, not automated systems.

- Comprehensive Fraud Detection — Detects risky IPs, proxies, and bots across industries.

- Shared Intelligence — A community defense system powered by data from multiple companies.

- Machine-Learning Accuracy — Continuously updates to detect new fraud tactics.

- Low Latency API — Integrates easily into registration, payment, or login systems.

- Cost-Efficient — Reduces chargebacks, fraud losses, and reputation risks.

- Privacy Compliant — GDPR-compliant operations with anonymous scoring methods.

While Scamalytics is designed for good, businesses must balance fraud prevention with user privacy rights.

The platform itself complies with GDPR, ensuring that user data is never personally identifiable and is used strictly for fraud prevention.

Still, companies integrating Scamalytics should clearly disclose such tools in their privacy policies and ensure transparency with their users.

Even the best systems have their challenges:

- False Positives: Legitimate users using VPNs may be mistakenly flagged.

- Integration Complexity: Smaller firms may need technical support for API setup.

- Adaptive Threats: Fraudsters evolve — no system is 100% immune.

- Dependence on Shared Data: The network’s accuracy improves only when more platforms contribute data.

However, most users and businesses find that these limitations are far outweighed by the security benefits.

Scamalytics isn’t just a company; it’s part of a global shift toward intelligent fraud detection.

In an age where trust online is fragile, Scamalytics represents a bridge — connecting machine learning, ethics, and business protection.

The rise of AI-driven fraud prevention tools like Scamalytics shows how collaboration and data sharing can protect the digital economy as a whole.